The Bottom Line

Facebook and Google are strong players in the digital ad space, and the rise of video as an advertising medium is not exactly a state secret. Amazon throwing its hat in the ring has huge implications for the market, especially because Amazon is king when it comes to consumer intelligence. And consumer intelligence is fuel in the engine of effective advertising. See the connection?

What’s your take? It will be interesting to watch Amazon’s roll-out unfold.

Additional Resources on This Topic:

Amazon Raises Ad Stakes with Video AdvertisingBottom of FormReport: Facebook’s display ad domination to grow as US digital ad spend hits $83B in 2017

Photo Credit: marvelousapps Flickr via Compfight

Small Business badge and certifications

Charmaine James’ company, Locsanity, is one of the small businesses who have received the Small Business badge in Amazon’s store.

The Small Business badge appears on listings to help products from small businesses stand out. Amazon customers who like to support small businesses can use the Small Business filter to discover products with the Small Business badge.

If you meet Gartner’s definition of a small business, the products you offer can qualify to receive the Small Business badge in the U.S. According to Gartner, small businesses typically have fewer than 100 employees and less than $50 million in annual revenue. If you meet the criteria and have headquarters in the U.S., here’s how to get the Small Business badge:

- Sign up for a

- Enroll in Amazon Brand Registry or Amazon Handmade

- Sign up for the Amazon Business program

Once you’re enrolled in Amazon Business, go to B2B in the main menu of your Seller Central account, then click on Certifications.

Matt Rollens, the founder and CEO of Dragon Glassware, shares how the Small Business badge has helped his brand gain exposure and connect with customers:

Products can also qualify for the Black-Owned Business badge. Professional Amazon sellers can use this badge to signal to customers that they have a valid and active minority-owned registration or certification. This can appeal to discerning customers. For instance, some businesses have policies directing their employees to place purchases in order to meet social responsibility goals.

Did you know?

Black Business Accelerator empowers Black-owned businesses

Amazon’s Black Business Accelerator (BBA) is dedicated to helping build sustainable growth for Black-owned businesses by targeting barriers to access, opportunity, and advancement.

Learn more about Black Business Accelerator (BBA)

The Black-Owned Business badge is one of several certifications Amazon sellers can use to boost sales. Other certifications include:

- Woman-Owned Business

- Minority-Owned Business

- Veteran-Owned Business

Check out this case study to learn how a Black-owned and veteran-owned business used diversity certifications to reach new customers across industries.

Traditional banking institutions have been fending off the threat of self-made start-up fintech organisations since the concept of fintech first made its way into our vernacular

It has been years in the making. Traditional banking institutions have been fending off the threat of self-made start-up fintech organisations since the concept of fintech first made its way into our vernacular.

The fear was that one, or several, of these tiny upstarts would wade their way into the financial services industry and render many of the existing processes redundant. It wasn’t that an already established retail giant would muscle its way in and take another enormous step in its masterplan to take over the world.

That threat, of course, is Amazon and Jeff Bezos, the undisputed king of the online jungle.

It isn’t a new notion. The term Amazon Bank is one that has been bandied about for several years now. The company already offers financial services; product financing and credit cards are the current extent of this, but more recently the retailer has been ruminating about making a retail type banking offering for everyday checking accounts.

Earlier this year, it announced discussions with JPMorgan Chase to establish checking accounts with the bank, targeting the young and the unbanked. The fear factor here was lessened by the joint venture aspects of the plan, given that the accounts would be Amazon branded Chase accounts – not Amazon accounts per se.

Given the vast data stockpiles that the company already has to hand like customer spending patterns and purchasing history, the ability to control the checking accounts of its 100 million-plus Prime users in the US, and eventually no doubt worldwide, would be hugely significant. The retailer already offers discounts to members for purchases made in its Whole Foods Supermarkets, and blanket retail discounts for Amazon Bank customers would no doubt be attractive to Besos’ loyal and ever growing fan base — not to mention the power it could wield from monopolising the small debt or loan markets.

Still, in May, a note issued by Goldman Sachs suggested that analysts at the bank were not concerned with such a venture, and felt it more likely that the retailer would continue to concentrate on its core markets before spreading itself any thinner.

These regulatory issues have no doubt been what has prevented Besos from making this jump already. In the US it isn’t a simple task to become a bank, even with the power and capital that Amazon has readily available. Gaining a charter is an arduous task that requires a significant amount of capital and the ability to prove endurance through times of intense stress.

However, following the advice of the Treasury this month, the Office of the Comptroller of the Currency (OCC) paved the way for fintech companies to make applications for special fintech banking charters – a route previously reserved for traditional banking institutions. It’s early days, and there is no guarantee companies will take the OCC up on the offer but it’s certainly a change in the regulatory framework that might make the likes of Goldman Sachs less confident that they will be able to maintain their relative superiority in the space, and fend off the charge from Besos.

It may well be that the de facto Lord of the Amazon, may become the King of the banking jungle sooner than anyone had anticipated.

Elevate Brands: Ad Data Organization

Elevate Brands is one of the most unique e-commerce companies. They purchase brands on the Amazon marketplace and elevate them using various scalable techniques that align with business goals. This may include offering partnerships or buying out businesses entirely.

The company offers transparency throughout the entire process, making this an excellent solution for small businesses struggling to take their brand to the next level. Even though they provide many resources to small business owners, creating ads for numerous companies proved to be a serious challenge.

The Challenge: Streamlining Data Analysis Across Multiple Amazon Stores

Elevate Brands tried to pull data from 35 different companies when they started their advertising strategy on the Amazon marketplace. They were waiting weeks to receive insight and needed a solution that tracked the right metrics on one platform. They also wanted this data to be available immediately, so they could adjust their campaign when required.

Strategies: Migrating all Advertising Data to Cloud Solutions

The brand contacted an ad and analytics company operating on the cloud. The cloud company could take data from all 35 companies and place it on a single dashboard, which allowed Elevate Brands to see how many ad impressions each company generated.

They pulled and organized all advertising data on their cloud platform, updating all metrics automatically. The platform offered a very visual dashboard that was easy to read, ideal for the advertising team to change their bid strategy when needed.

Results: Integration of 500+ Data Sources for Holistic Analysis

Elevate Brands had a combined total of over 500 data sources from over 35 companies:

The cloud company combined all this data on one platform, and they were able to make changes and experiment with different advertising strategies while receiving timely updates.

Dive Deeper: 10 Easy Product Page Design Strategies That Will Boost Your Conversions

Wells Fargo

Chatbot

Wells Fargo hasn’t publicized many artificial intelligence initiatives, but Steve Ellis, head of the bank’s Innovation Group, seemed eager to leverage AI in a 2017 press release for a chatbot pilot:

The chatbot was piloted on Facebook Messenger and made available to 5,000 customers and employees. AI vendor Kasisto built the chatbot; the company was among the conversational interface vendors that scored highest on its Overall Score in our AI in Opportunity Landscape research, indicating relatively high funding, robust AI talent on its leadership team, and a history of success with its clients.

As a result, Wells Fargo’s chatbot was likely capable in comparison to others, but it’s unclear if the bank decided to roll out the chatbot to all of its customers.

Predictive Analytics – Predictive Banking

However, customers do have access to Wells Fargo’s artificial intelligence-based Predictive Banking application via smartphones. Below is a brief video providing an overview of the software:

https://youtube.com/watch?v=KbToD8L1qnQ

Predictive Banking includes features such as:

- Alerting customers of higher-than-average recurring billing payments

- Reminding a customer to transfer money into their savings account if they have more money than average in their checking account

- Prompting customers to set up a travel plan for their account after they’ve purchased a plane ticket

McGee also said that Wells Fargo had planned to offer Predictive Banking to credit card and small business mobile customers in late 2018, but it’s unclear if they did so.

How do I find out why customers are returning my product?

To know the reason for the FBA returns, you can view the FBA customer returns report. One way to access that report is by:

-

Logging in to your Amazon Seller Account

-

Clicking on the “Reports” tab

-

Choosing “Fulfilment” from the options that appear

-

Finding and clicking “FBA Customer Returns”.

There, you can choose a Date Range (e.g. last 30 days) and generate a report.

In the dashboard and report, you’ll see the following details about the customer’s returned items:

-

Returned date

-

Return ID

-

Merchant SKU

-

ASIN

-

FNSKU (fulfilment network stock keeping unit)

-

Title (item name)

-

Quantity

-

FC (fulfilment centre)

-

Disposition (condition of the returned product such as Sellable or Defective)

-

Customer Return Reason

-

Status

Under the “Customer Return Reason”, you might see any of the following:

-

Item is defective

-

Refused (buyer refuses delivery)

-

Unwanted item

-

Size too small/short

Once you know the most common reasons, you can then inspect your items and processes and find out what caused the defects or other reasons for the returns. For instance, if you always see “Item is defective” in the Customer Return Reason, it makes sense to do the following:

-

Make your product listings inactive (so customers won’t be able to buy your products)

-

File a removal order and personally inspect the products (the defects might be due to a manufacturing error or inappropriate handling or storage)

It’s good to look at the Customer Return Reason regularly so you can take action immediately before more customers buy the item, get disappointed, and leave negative reviews.

Another common Customer Return Reason is “Size too small/short.” To help address this, you should provide a clear sizing guide and instructions so customers can always get the right size for their shoes and clothing.

The Starling Bank success story 🚀

Founded in 2014 and voted best British bank in 2018, 2019, and 2020, Starling Bank now has more than 2 million customers, an unprecedented achievement in the banking world. Founder Anne Boden’s vision was quality of operational execution and technological innovation. While several factors can obviously explain the dazzling success of this British fintech company, the main reason for its meteoric rise could well lie in its business model as a pioneer.

And for good reason. Just as Amazon, the American giant, managed to revolutionize e-commerce, the British scaleup is revolutionizing financial services by positioning itself, above all, as a financial marketplace, i.e., a marketplace where companies and individuals can access a range of third-party financial products and solutions directly within the Starling Bank application.

Let’s take a moment to analyze in-depth the reasons for Starling Bank’s success and the challenges its employees have brilliantly met over the past few years.

Digital Banking: What is it?

One of the most important developments for contemporary financial systems is the advent of digital banking. Maintaining competitiveness while adapting to changing times is a struggle for many in the banking industry.

The main objectives of digital banking trends are to improve customer service, cut administrative expenses, and digitize financial infrastructures. This includes better monitoring tools, bank-to-bank payment processing, automatic warnings, and services that are tailored for speedy payments.

A growing number of banks are employing AI or firms, like Luxoft. To improve service while lowering costs and maximizing outcomes.

Trends in Digital Banking

Cybersecurity

Nowadays, organizations are very concerned about cybersecurity. Cybersecurity must be taken into account as a crucial step in the development process of banking software. With the aid of data compliance management and security rules, it facilitates the processing of vast quantities of sensitive customer data. Additionally, integrating it lowers the possibility of data breaches with various technologies and aids in identifying and stopping shady activity and illegal access.

A Predictable Personalization Tool Using Data

Big data, machine learning (ML), and artificial intelligence (AI) push financial marketers to provide greater personalization to banking customers. Personalization in this digital age refers to more than just basic information like a customer’s name. Instead, it entails getting to know your client’s preferences and creating customized packages of financial services and products for each client following their needs and preferences. Customers of digital banks get access to tailored financial trends.

Consumers would find it beneficial if «living profiles» with more specific personal preferences were utilized to design tailored experiences, goods, offers, and financial solutions, according to Accenture. Customers expect businesses to swiftly grasp their preferences, particularly when they have previously provided comprehensive data. The key to providing the finest customer journey experience is personalized marketing.

Voice Banking

As voice assistants like Amazon’s Alexa and Google Assistant grow more common, voice banking is another innovation that is likely to influence the future of banking. Banking transactions may now be carried out via voice commands, making it even more accessible and easy.

Mobile Banking Continues to Outperform Online Services

90% of Gen Xers in the US favor banking via smartphones. 50% of Americans over the age of 65 have this rate. You need a mobile app that performs better than or is at least as effective as your rivals to draw in clients. Although it is an addition to the mobile solution, a web platform is also required.

Consumer demand for mobile applications that can perform any financial task is driving the transformation of digital banking. Bank branches could cease to exist by 2034. In light of this, you should start keeping up with the latest technological developments in Internet banking right now.

Blockchain

Blockchain increases transactional security and transparency by providing tamper-proof records of all financial transactions. Furthermore, it simplifies manual and paper-based activities while also increasing trade efficiency via transaction automation. Financial contracts perform better thanks to smart contracts, which automate financial transactions.

Safeguards

Evolve has implemented various processes to safeguard personal information and restrict access to private information to personnel who need to know the information in order to service clients. Security measures include passwords on networks and systems and restricted access to the offices, and records within the offices.

Employees should be mindful to ensure that unitholder information is protected. Generally speaking, employees are not to disclose to other employees who do not have a legitimate need for the client information. In particular, all information and materials that employees access must be kept confidential, even after employment has ended. Annually, each of Evolve’s employees is required to attest to compliance with Evolve’s policies including the Privacy Protection Policy.

Note on Media: employees are not to communicate with the media – all media inquiries must be directed to Keith Crone.

FAQs Section

What are the primary digital banking trends shaping the industry?The key digital banking trends include the rising dominance of mobile banking, the integration of AI for personalized customer experiences, the disruptive influence of fintech companies, the adoption of contactless payments, and the exploration of blockchain and open banking initiatives.

How does AI enhance the digital banking experience for customers?

AI in digital banking enables personalized services by analyzing customer data and behavior, allowing banks to offer tailored product recommendations, improve customer support, and streamline banking processes for a more efficient and user-friendly experience.

The competitive threat of ‘free’ shipping

UPS has depended on the cash cow of package delivery for about a century.

The company began a messenger service in 1907 that became United Parcel Service in 1919. By 1975 it served every address in the U.S. and started expanding internationally.

For decades, UPS and FedEx virtually have had a shipping duopoly across the country, with UPS becoming better known for its extensive ground network and FedEx for its overnight shipping by air. The postal service also is a major player, but it focuses on slower delivery of mail.

UPS’s massive global shipping network has long stood as a bulwark against competitors, because of the cost of building the infrastructure to move so many packages around the world so quickly. DHL made a major U.S. push after being acquired by Germany’s mail monopoly Deutsche Post, promising that «yellow is the new brown» in an advertising campaign. By 2008 it had retreated, transferring air-parcel deliveries to UPS and slashing its ground network.

Amazon has proven a much tougher challenger because it is a giant online retailer. Through its own fulfillment network, it can ship products for the millions of businesses selling them on its website.

The company started as an online bookseller in 1994, partnering with national bookstore chain Borders Group in 2001 before driving it out of business. After it expanded its product offerings, other retailers like Circuit City, Sears and Toys «R» Us filed for bankruptcy protection.

Today, Amazon’s revenue is nearly five times that of UPS and its stock market capitalization nearly 10 times bigger.

Amazon’s retail strategy has succeeded in part by promoting two-day and next-day delivery, as well as free shipping.

On its website, Amazon suggests to e-commerce businesses that they increase prices to cover the cost of free shipping. For consumers the cost of shipping becomes more opaque, wrapped into the total price of the product.

«There’s no such thing as free shipping,» said Bill Seward, UPS’s president of global customer solutions. «Even if you don’t want to charge for it, it’s costing a lot.»

Still, Amazon doesn’t see shipping as a profit center, and is likely willing to accept lower shipping profit margins than UPS.

Amazon founder Jeff Bezos «has for a long time said, ‘Your margin is my opportunity,'» said Satish Jindal, president of shipment technology firm ShipMatrix. If Amazon uses a service that makes better margins than Amazon, Bezos will «want to bring it in house,» Jindal said.

John Haber, chief strategy officer for Transportation Insight, believes Amazon is subsidizing shipping costs with revenue from its massive cloud computing business.

Amazon’s own infrastructure keeps growing. In Georgia alone, it has more than 30 fulfillment and sortation centers, nine delivery stations, a tech hub, air gateway and Amazon Hub lockers, as well as 12 Whole Foods Market locations.

The company has ordered 100,000 Rivian electric delivery vans and has been testing package delivery robots in Atlanta. In the air, it has more than doubled its flight network in the last couple of years and now has 85 planes in its Amazon Air fleet. It also has expanded at Hartsfield-Jackson International Airport since launching flights there in 2019.

US Bank

Predictive Analytics – Expense Wizard

US Bank recently launched Expense Wizard in collaboration with vendor Chrome River. Expense Wizard is an artificial intelligence-based expense management mobile app that allows users to charge businesses for travel expenses without having to pay up-front themselves first.

The bank claims Expense Wizard is a chatbot that integrates into Chrome River’s expense reporting software. The software is explained further in the video below and a promotional video can be found on US Bank’s website:

According to US Bank, using Expense Wizard, a hiring manager can provide a virtual card to a candidate via the app, setting a card limit via US Bank.

The candidate would then receive access to the card through the Expense Wizard app, allowing them to buy plane tickets and book a hotel. They can also access details about the flight and hotel in the app.

The candidate can then use the app to make other travel-related purchases. All of these purchases are recorded and sent to the business for final approval. At the end of the candidate’s trip, they can submit the expense report to the business.

Bradley Matthews, Senior Vice President, Head of Product Management and Marketing at US Bank, had this to say about the software:

Move Beyond ROI With Snap Agency

Interested in learning more about Snap’s digital growth solutions and how they can poise your e-commerce company for long-term results? Then be sure to call or message us today. Whether you need help with driving traffic and conversions or enhancing customer loyalty, our team of digital marketing experts can help.If you’re still hungry for information on Amazon, then check out our related post, Snap’s Amazon Statistics + Infographic! We also have a detailed guide to help you decide whether you should sell your products through Amazon. Best of luck on your e-commerce journey, and don’t hesitate to reach out if you need help. We’re always here for you.

A new business model: Amazonization 💡

Regulations such as PSD2 and Open Banking are changing what customers want while reshaping the banking landscape. This will lead to a significant change in banks’ future business models. New players, fintech companies, and neobanks, without any process or legacy backing, are taking advantage of the situation and entering the market with a robust online offer. In addition, they’re more transparent in terms of pricing and realize that data is their most valuable asset in developing their offerings. They also operate beyond their borders and are easy to use across Europe, whether opening an account, executing a transaction, or viewing accounts.

Incumbent players in Europe are struggling with high costs and the need for considerable investment due to legacy IT systems and competition from new entrants. Nowadays, traditional banks are facing a multi-pronged attack on their operations from neo-banks (or Challenger Banks), fintech companies, and big tech.

Amazonization as a response to market threats? The notion of Amazonization is a phenomenon born out of the large-scale disruption in the retail industry caused by Amazon. The company was born in the initial dot-com era, and its growth has been exponential since 2010, with the retail giant increasing more than fivefold in value.

Amazonization refers to a shift in power to the customer. If you apply that shift to the financial services industry, platforms will become the dominant, customer-facing user interface. Platform customers will be able to search, buy and manage products. They will be offered the best price and value for their needs according to their parameters, which they set on the platform. In addition, they will be able to see other buyers’ comments and opinions before making their choice. European banks must adopt the concept of Amazonization and become product aggregators, thus providing one-stop-shopping to meet their customers’ banking needs.

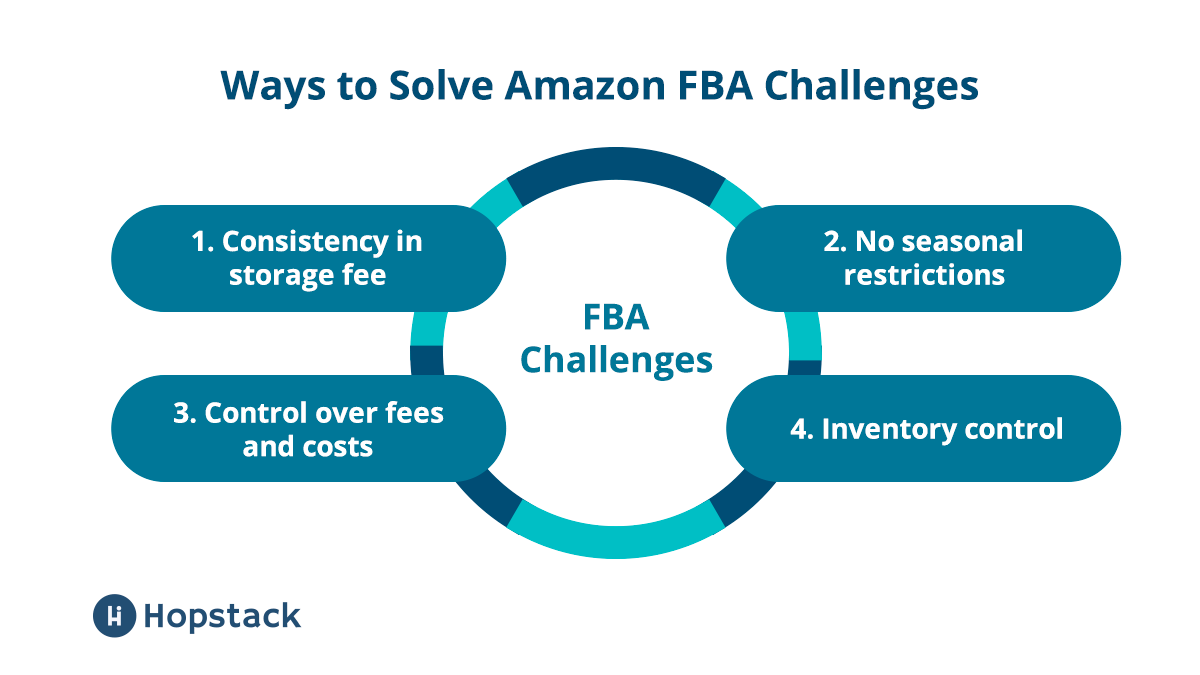

How To Solve Challenges Faced By Amazon FBA Sellers

As manufacturing and trading companies grow in revenue and volume of units sold, there is an innate need for them to set up their own fulfillment operations. This involves setting up their own order fulfillment warehouses and tying up with a shipping service such as FedEx, UPS, etc. Taking ownership and control of the entire fulfillment cycle proves to be beneficial to a growing company and solving challenges faced by Amazon in many ways such as:

Consistency in Storage Fee

Maintaining a dedicated warehouse offers sellers the advantage of greater control over their inventory and helps mitigate the impact of fluctuations in storage fees, a concern often tied to seasonality or changes in inventory performance metrics, such as Amazon’s Inventory Performance Index (IPI).

One key benefit of using a dedicated warehouse is the ability to plan and manage inventory storage costs more effectively. Unlike Amazon’s fulfillment services, where storage fees can vary based on factors like seasonal demand or a seller’s IPI score, having a dedicated warehouse provides a consistent cost structure. Sellers can forecast storage expenses with greater accuracy, facilitating more precise budgeting and financial planning.

No Seasonal Restrictions

As discussed above, Amazon may at any point in time, impose limitations on the storage space allocated and the restock quantities allowed to a merchant. This is the reason why the number of FBM sellers grew by over 20% in 2021. FBM allows sellers to have full control over their warehouse space utilization.

Additionally, Amazon’s Fulfillment by Amazon (FBA) program, while offering convenience and a wide-reaching customer base, comes with potential drawbacks, such as seasonal limitations on storage capacity. During peak seasons or when inventory performance metrics fluctuate, FBA sellers may encounter restrictions on the volume of goods they can store in Amazon’s fulfillment centers. This limitation can be a significant hurdle for sellers looking to capitalize on seasonal demand or fluctuations in market trends.

Control over Fees and Costs

Operating independent fulfillment operations outside of Amazon’s services grants businesses greater control over their cost structures, liberating them from potential challenges associated with Amazon’s fee structures and pricing policies.

One significant advantage of managing fulfillment independently is the ability to avoid certain fees imposed by Amazon. For example, third-party sellers using Fulfillment by Amazon (FBA) are subject to fees for storage, order fulfillment, and additional services. By handling fulfillment in-house, businesses can eliminate or reduce these fees, leading to potential cost savings. This independence allows companies to make strategic decisions about their fulfillment processes, optimizing them for efficiency and cost-effectiveness.

Inventory Control

Should a company wish to move its inventory out of Amazon’s warehouses, it is subject to high fees and taxes. This is a major issue faced by sellers and is all the more severe in the age of the pandemic where 93% of all SME Amazon sellers have experienced supply chain disruptions. However, this can be prevented with the company’s own independent warehouses.

The pandemic has been a challenging period for all retailers alike, e-commerce or not. One important lesson learnt is that Amazon doesn’t always have the sellers’ best interests in mind. That’s why so many companies, from multi-billion dollar Nike to SMEs are parting ways with Amazon and taking charge of their fulfillment process. A lot of scaling businesses are beginning to realize that the benefits of taking ownership of their operations far outweigh the vast network Amazon provides.

The move from an arrangement like the Amazon FBA to insourced order fulfillment is complex and challenging for large and small businesses alike. Firstly, they must find and compare different shipping services that can provide the transportation infrastructure suitable for their products and the target market. Similarly, they also need to have a robust Warehouse Management System (WMS) that can assist and automate the activity of providing data-driven actionable insights for better inventory control, multi-channel order management and batching, picking and warehouse packing processes, and overall fulfillment efficiency.

Schedule a demo today to understand how Hopstack’s AI-driven WMS can help you supercharge your warehousing operations and can make the switch to in-house fulfillment seamless!

The Amazon Advantage

When it comes to technology, financial institutions are very far behind. According to a Bain report, “traditional banks have “barely touched” technologies that are becoming ubiquitous in the American economy.” And, unfortunately, as consumers become more and more tech-savvy, financial institutions continue to fall behind. The Bain report found that “nearly one-fifth of U.S. survey respondents use voice assistants at home while one-quarter would consider using voice-controlled assistants for everyday banking.”

And while financial institutions are trying to catch up, Amazon is well positioned to dominate the financial industry, not only from a customer experience perspective, but also from a data angle. “Amazon…has a big opportunity in banking services given its immense data platform a critical advantage.” And although financial institutions have a wealth of customer data, arguably the most out of any industry, they don’t know how to use it as effectively or efficiently as Amazon and other big tech companies.

Amazon Cash

The Amazon Cash product (launched in 2017) was created for users to deposit cash, which would then be used in the Amazon app for purchases (instead of cards). A customer can go into a physical store (such as 7-Eleven) and show a barcode (linked to their Amazon account), then hand cash that would be deposited and credited right away (without a fee). It offered a bridge to customers that didn’t qualify for a bank account (unbanked) to be able to make digital purchases without a card. Through a partnership with CoinStar (in 2018), coin deposits could also be made and credited to an Amazon account.

With this same theme of expanding services, Amazon launched PayCode — a product that allows for new customers to make purchases with cash and QR codes in developing countries. Regions in Africa, Southeast Asia, and South America have been able to pilot this program in partnership with Western Union (the company providing the infrastructure for payments). By visiting their local Western Union and depositing cash, a consumer can then make a purchase. This helps expand Amazon’s coverage to unbanked internationally.

Kids and teens were also being offered services via Amazon Cash with a feature called Amazon Allowance. Minors now had the capability to have their own Amazon account (after verifying parental consent) to make purchases. Parents would fund these accounts and supervise spending. Unfortunately, Amazon pulled the plug in July 2020 on this capability. Still seeing potential in this younger user segment for Amazon Cash, the company invested in Greenlight (teen banking app) in December 2017.

There’s tremendous opportunity for the giant to continue its expansion of services to unbanked and underbanked globally with Amazon Cash and Paycode, and increasing partner locations to accept cash and coin deposits.

A question of trust?

I’m often asked about trust, about whether issues around Facebook and privacy, or the Australian reaction to My Health Record, make people less likely to trust an online finance system or reflect an expected lack of trust.

The answer is that the mechanism of trust is changing. Trust used to be about the fact that you can see a bank on the street corner, so you can trust them because they’ve got a building. But because banking is moving to the digital sphere, we now access our mobile apps hundreds of times more than we go into bank branches.

So we now have an expectation of banks being able to meet our needs in the digital sphere. The way we measure trust has changed. If the technology works, you trust that bank, or that non-bank financial brand.

Conversely, if your bank’s online and ATM systems went down for two weeks, and the only way you could get money out was to go to a branch, how much trust do you think you would have in the bank? That branch model doesn’t work anymore in building trust.

The good thing is that there are no downsides to new competition in the Australian market. We’re moving away from markets that are geared towards commodities such as resources, to economies where the biggest performers are technology companies. There needs to be big investment in technology for the Australian economy to remain relevant.

Find out more about how tech is shaping customers’ expectations of financial services, and how finservs can restore customer trust – download the Deloitte digital ebook ‘Restoring trust in financial services in the digital era’.

![What does amazon banking mean for you? [video]](http://triathlon21.ru/wp-content/uploads/3/0/4/304911b79ae5fa9eeccbc197bb0ad9f6.png)

![What does amazon banking mean for you? [video]](http://triathlon21.ru/wp-content/uploads/d/6/1/d618a985a0ae39ecebc5ca120642cc82.png)